The photonics and quantum technology firm fell into administration after a sharp downturn in sales, leaving debts of more than £60 million.

According to administrators Interpath Advisory, SNIB the state-backed investment bank created to support Scotland’s green and innovation sectors had total exposure of £34 million, comprising £22.3 million in equity and £15.2 million in loans. However, Interpath said there is no expectation of any recovery for SNIB or Santander, which is owed £14.2 million.

Scottish Enterprise is also owed £2.9 million, and HMRC has submitted a claim exceeding £1.5 million. Several Scottish universities are among other creditors.

“We do not anticipate any sums will become available for Santander or SNIB under the terms of their respective charges,” the administrators reported.

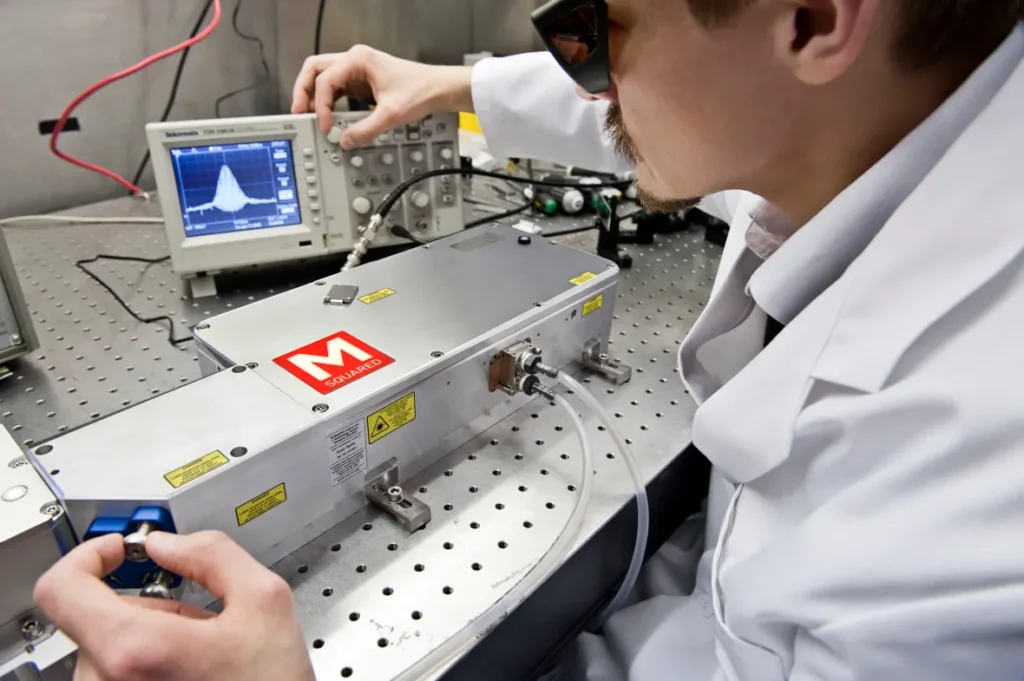

Founded in 2006 by physicist Dr Graeme Malcolm, M Squared had been celebrated as one of Scotland’s leading high-tech exporters, providing precision lasers and quantum instruments to universities and research organisations worldwide.

The firm recorded revenues of £17.8 million and a post-tax profit of £1.2 million in 2023, but turnover plunged to £4.2 million the following year, leading to losses of £13.7 million. All 28 staff were made redundant in August, when the company entered administration.

Interpath cited “depressed trading performance” and failed attempts to attract buyers, though discussions continue over the potential sale of its intellectual property.

The collapse marks another setback for SNIB, which also lost money this year on Krucial, a satellite technology firm, and Circularity Scotland, the operator behind the failed deposit return scheme.

Alexander Stewart, Scottish Conservative MSP, called the losses “a major cause for concern”.

“It’s taxpayers who ultimately foot the bill for failed investments,” he said. “The SNP should be promoting economic growth, cutting wasteful spending, and lowering taxes not taking a cavalier attitude to the loss of public money.”

Interpath warned that “insufficient assets” remain to repay unsecured creditors, meaning most will receive nothing back.

Although the organisation operates independently, its initial funding was provided by Holyrood, with ministers committing £2 billion over its first ten years. The long-term goal is for SNIB to become self-sustaining, reinvesting profits into future projects.

A spokesperson for SNIB said:

“The bank has worked with M Squared and other stakeholders to explore alternative solutions, but the challenging macroeconomic environment has led to the business entering administration and an expected loss for the bank. However, lasting value has been created through the skills and experience developed by its workforce.

“As Scotland’s development bank, we were established to address a clear gap in the Scottish funding landscape by supporting scale-up businesses with strong growth potential. While some failures are inevitable, our strategy focuses on the long-term performance of the overall portfolio.”

Scottish Enterprise was contacted for comment.